Reclaim Patient–Centered Care with Simple, Yet Smart, Medical Practice Technology

Deliver phenomenal patient and physician experiences with an integrated EHR, Practice Management, and Revenue Cycle Management (RCM) platform from OmniMD. We integrate EHR, Practice Management, and Revenue Cycle Software and Service into one solution to let you spend more time with patients, increase productivity, ensure information exchange, and improve your bottom line.

OUR FEATURES

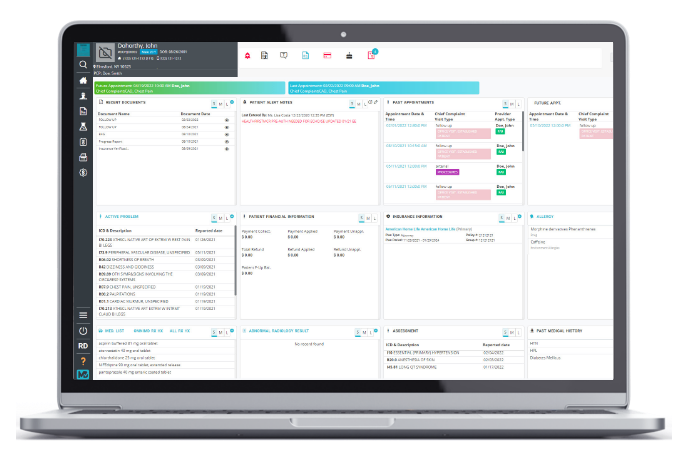

EHR Software

Simple yet savvy patient charting, decision-making, data transfer, and reporting.

Practice Management

Integrated practice management and billing software for better scheduling.

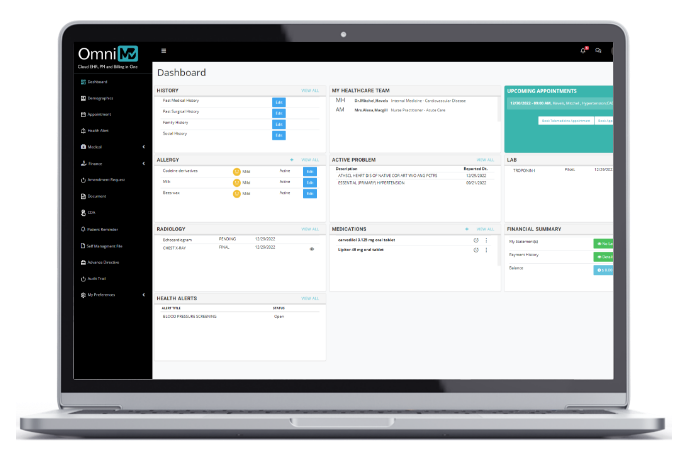

Patient Portal

Engage your patients with a wide variety of self-help tools and time-saving features.

Telehealth

Enable virtual visits to reduce travel and improve the patient experience.

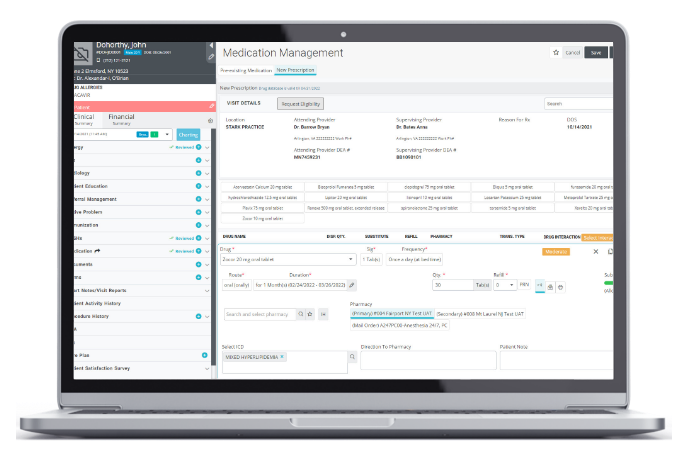

ePrescribing

Fast, safe, and securely prescribed controlled and non-controlled drugs.

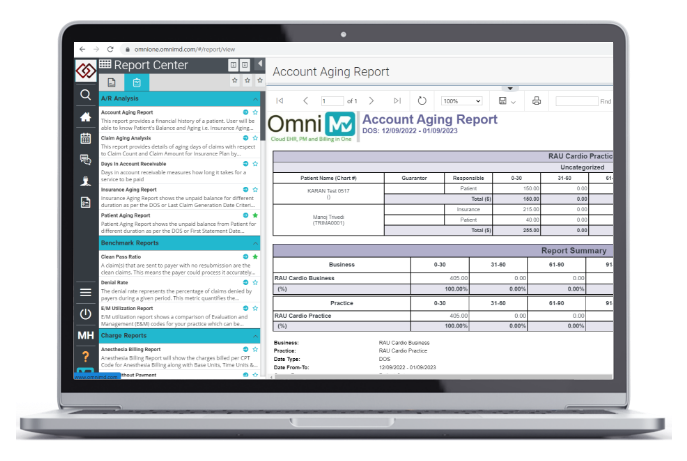

Managed Billing Services

Reduce staff and office footprint with outsourced revenue cycle management.

WHY CHOOSE OMNIMD

%

Healthcare Professionals

%

Healthcare Facilities

%

Customer Service Excellence

%

Patients Records

%

Uptime

%